How Much Federal Tax to Withhold From Paycheck

7 Minute Read | September 27, 2021

Think that hefty tax refund you got last year was basically a big bonus? Think again.

A big, fatrefund just means you've been loaning the government too much of your hard-earned cash with each paycheck, and Uncle Sam is simply returning money that was yours to begin with—that's why it's called arefund!

Or maybe you have the opposite problem. Maybe you're getting hit with massive tax bills and you're sick and tired of sending the IRS a big check every April. If that's you, we feel your pain.

If you're in either boat, it might be time to take a closer look at your tax withholding.

Tax Withholding Explained

Even though tax returns are due in April, you pay your tax bill a little at a time all year long through a process called tax withholding.

Tax withholding is simply the chunk of money your employer sets aside from each paycheck to cover your taxes. Withhold too much, and you'll get a tax refund. Withhold too little, and the IRS sends you a bill. The goal is to get as close to "$0" as possible.

Understanding the New W-4 Form

Whenever you start a job at a new company, you'll be asked to fill out a W-4 form that will help your employer figure out how much to withhold from each paycheck.

Taxes shouldn't be this complicated. Let us help.

For 2020, there is a new W-4 form that tries to provide a simpler and more accurate way to get your tax withholding right.

Why is there a new form? Well, since the 2018 tax reform bill got rid of personal exemptions, the new W-4 no longer uses "personal allowances" to figure out how much to withhold from your paycheck.

Instead, the W-4 is divided into five steps that will give employers the info they need to calculate your withholding:

- Step 1: You'll enter some basic personal information here—your name, address, Social Security number and expected filing status. Everyone has to fill out this step, but you only have to fill out steps 2–4 if they apply to you.

- Step 2: If you have more than one job, or you're married filing jointly and your spouse also works, fill out this step. You can use the IRS's tax withholding estimator or the worksheet on the form to calculate how much additional tax you'll need to withhold from your paycheck.

- Step 3: This step allows you to adjust your taxes based on how many child or dependent tax credits you expect to claim on your return.

- Step 4: Here's where you can make even more adjustments to your withholding for additional income (such as retirement income or interest), deductions outside of the standard deduction, and any additional tax you want withheld from each paycheck.

- Step 5: Then you'll just sign on the dotted line and you're done!

Now, if you've been at your job for a while you don't have to fill out a new W-4 form. But it could be a good idea to check it anyway, because the new form should help you get your tax withholding closer to where it needs to be.

And besides, it's always a good idea to do a "paycheck checkup" once in a while just to make sure your employer isn't withholding too much (or too little) on payday.

Why Do You Need to Adjust Your Tax Withholding?

Dave recommends adjusting your withholding so you break even (or get really close to breaking even) at tax time. In other words, you don't send the IRS a big check, and you don't get a huge refund back either.

IRS data shows that the average tax refund for the 2019 tax season was $2,725.1 So, let's say you got paid every two weeks and received the average refund. That means you should've had an extra $105 in every paycheck last year! Think of what you could do with $200 or more each month!

And if you went through a major life change over the past year that might impact how much you owe in taxes—you got married, bought a house, or welcomed a baby into the world—it's a good idea to take a fresh look at your tax withholding and make any adjustments.

How to Calculate and Adjust Your Tax Withholding

Ready to get your tax withholding back on track? Here's how.

Step 1: Total Up Your Tax Withholding

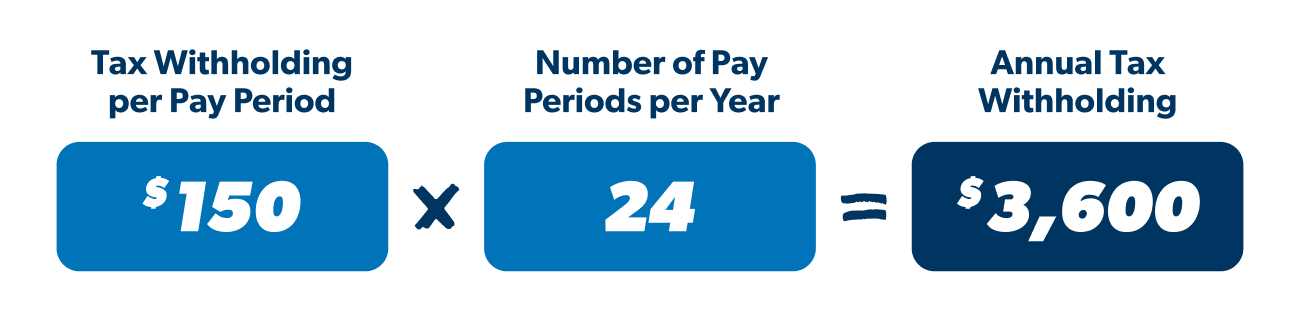

Let's start by adding up your expected tax withholding for the year. You can find the amount of federal income tax withheld on your paycheck stub. Let's say you have $150 withheld each pay period and get paid twice a month. That would be $3,600 in taxes withheld each year.

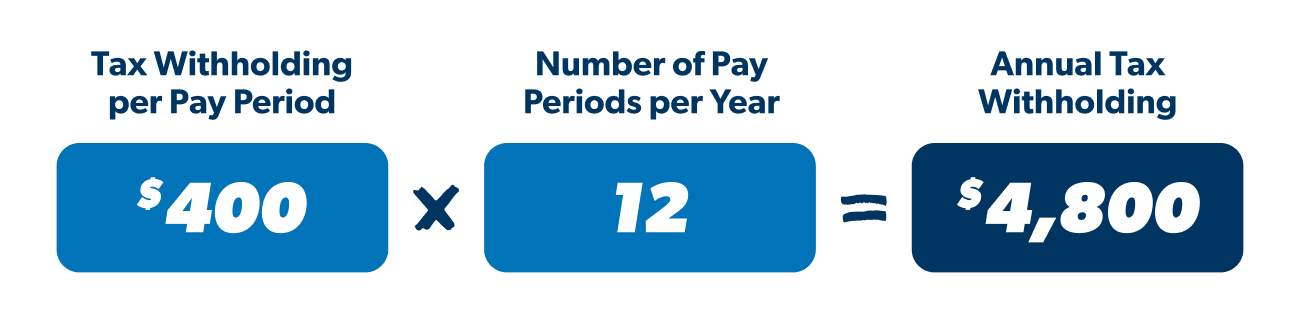

If you're single, this is pretty easy. If you're married filing jointly and both of you work,calculate your spouse's tax withholding too.In this example, we'll assume your spouse has $400 withheld each pay period and receives a monthly paycheck.

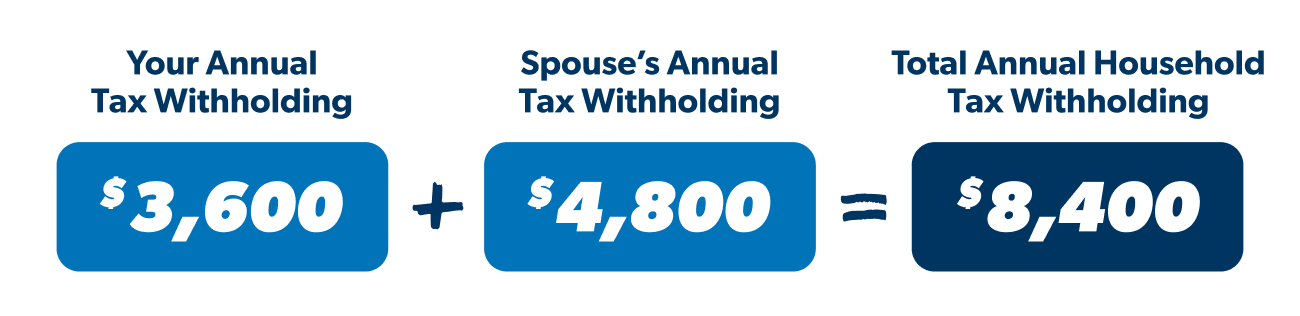

Then add the two together to get your total household tax withholding.

Step 2: Estimate Your Tax Liability

Now that you know your projected withholding, the next step is to estimate how much you'll owe in taxes for this year.

The IRS provides worksheets and a tax withholding calculator to walk you through the process, which is basically like completing a pretend tax return.

If you're married and filing jointly, for example, and your taxable income is around $81,900 for the 2020 tax year, that puts you in the 22% tax bracket. So, your tax liability, or what you owe in taxes, is about$9,600.

Remember, federal taxes aren't automatically deducted from self-employment income. If you have a side business or do freelance work, it's especially important to factor that income into your tax equation.

Step 3: Subtract the Difference

Once you have an idea of how much you owe the IRS, it's time to compare that amount to your total withholding.Take your annual tax withholding and subtract your estimated tax liability.

Let's continue our example from above and assume your estimated tax liability is $9,600. In that case, you'd have a potential $1,200 deficit.

A positive balance indicates a refund, while a negative balance means you owe more and may have to pay the IRS interest and a penalty at tax time. The good news is you can fix it before tax time ever rolls around!

Step 4: Adjust Your Withholding

If you run the numbers and find you've got ground to make up, it's best to adjust your tax withholding as quickly as you can. The longer you wait, the harder it will be to get it just right. You have two options:

- File a new W-4 and submit it to your employer.If you've been at your job for a while and you've been getting big refunds or tax bills for years, filling out a new W-4 could help you get your tax withholding right.

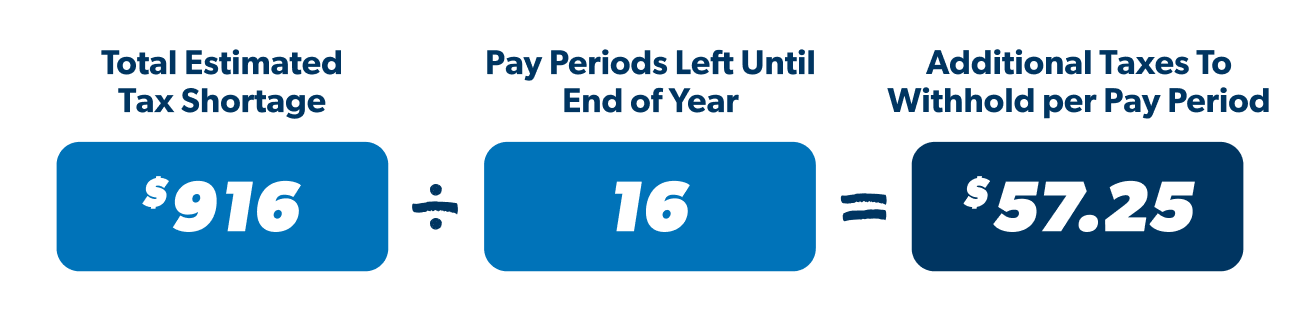

- Specify additional withholding. As mentioned above, you have the option on the W-4 form to enter an additional amount you want to have withheld with each paycheck. Simply divide your estimated tax shortage by the number of pay periods you have left before the end of the year to get your number.

Work With a Pro

If you get stuck along the way or don't feel comfortable with your numbers, ask a tax advisor for help. They can make sense of your personal tax situation and guide you toward a reasonable target. With a few minor adjustments, you can strike a better balance and look toward next year's tax season with a lot less stress.

Find your tax pro today!

How Much Federal Tax to Withhold From Paycheck

Source: https://www.ramseysolutions.com/taxes/how-to-calculate-tax-withholdings